EU Tightens Steel and Ferroalloy Import Rules, Creating a New “Iron Curtain” for Global Suppliers

The European Union has announced major changes to its trade defence rules for steel and ferroalloys. These updates mark the biggest shift in EU metals import policy in more than a decade. With global steel overcapacity rising and EU decarbonisation targets becoming stricter, Brussels has introduced:

i. A new permanent steel import regime from 2026

ii. Immediate safeguard measures on ferroalloys, already active

These actions sharply increase trade barriers, compliance rules, and costs for suppliers and importers.

1. New EU Steel Import System Coming in 2026

On 7 October 2025, the European Commission released proposal COM (2025) 726 final, outlining a stricter steel import regime to replace current safeguards expiring in June 2026.

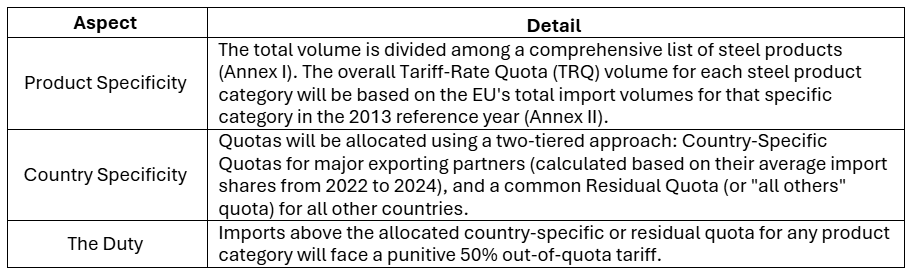

Elements include:Drastic Quota Reduction and Tariff Hike: The annual volume of steel that can be imported into the EU without a tariff will be cut by approximately 47%, from roughly 33 million tonnes to 18.3 million tonnes. The duty on steel imports that exceed the new quota will double from 25% to 50%. The 18.3 million tonnes figure is the aggregate total annual target. The actual mechanism is structured by being both product-specific and country-specific.

|

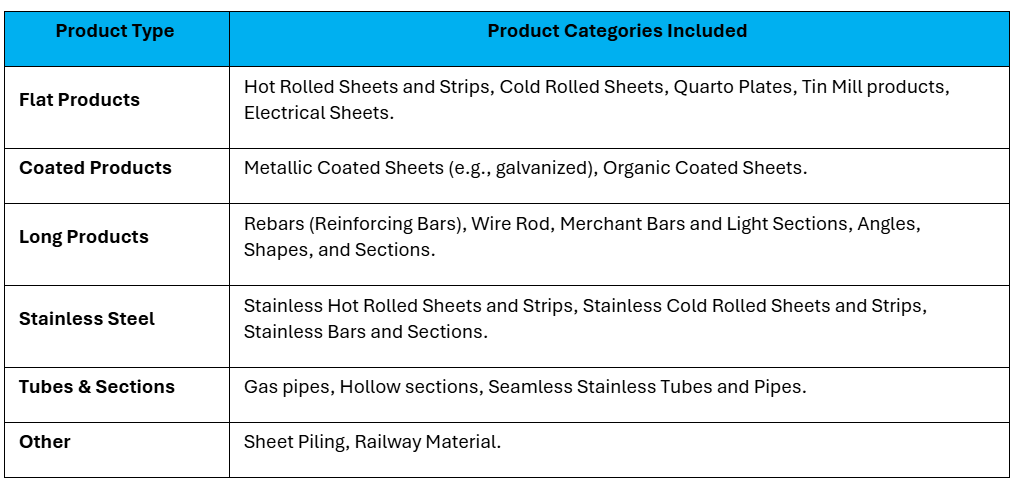

The proposed measure affects a wide range of steel products, encompassing approximately 26 categories (identified by specific CN codes) that are crucial to the EU economy.

|

The "Melt and Pour" Rule: A critical innovation is the introduction of the "Melt and Pour" rule for determining a product's country of origin. Importers will be required to prove that the raw steel was first melted and poured in the claimed country of origin. This is intended to prevent circumvention, but it dramatically increases the administrative burden and compliance risk for importers and traders.

Higher Costs and Supply Chain Risk: Downstream users (like automotive and construction sectors) warn that the reduced quota and 50% duty will lead to significantly higher input costs and supply chain disruptions, especially for specialized products where EU domestic supply is insufficient.

Limited Exemptions: While the regime will be applied uniformly, limited exceptions are foreseen for the three non-EU members of the European Economic Area (Norway, Iceland, and Liechtenstein). The proposal also suggests that the interests of EU candidate countries (such as Ukraine) may be considered in quota allocations.

Reasons for the proposal

The EU's goal is to shield its steel sector from the impact of global overcapacity and what it considers to be unfair competition. Officials believe the measures will help the EU steel industry invest in decarbonization by making it easier to increase its capacity utilization rate from the current 67% to a more sustainable level near 85%. The new proposal is a response to the expiration of the current steel safeguard measures under World Trade Organization (WTO) rules.

2. Current Safeguards Remain Until June 2026

The current system, which will remain in force until June 30, 2026, is governed by Commission Implementing Regulation (EU) 2019/159 and its subsequent amendments, notably Implementing Regulation (EU) 2025/612.

Important Changes Introduced by 2025/612:

Reduced Liberalisation Rate: The annual liberalisation (growth) rate of the Tariff-Rate Quotas was reduced from 1% to 0.1%, severely limiting the incremental increase in duty-free import volumes.

Elimination of Carry-Over: The mechanism that allowed countries to roll over unused quarterly quotas to the next quarter was eliminated for categories under high import pressure.

Quota Management Adjustment: The 26 steel product categories covered by the safeguard were grouped by market pressure, leading to differentiated access rules, particularly for "residual quotas" used by countries without specific allocations

3. Ferroalloy Safeguards Take Immediate Effect (From 18 November 2025)

In a parallel move, the EU has imposed definitive safeguards on ferroalloys—critical inputs for steelmaking—effective immediately and lasting until November 2028.

Impacts on EU Importers:

New Costs on Inputs: Ferroalloys (such as ferro-manganese and ferro-silicon) are crucial alloying materials for steel production. Importers now face country-specific Tariff-Rate Quotas (TRQs).

Variable Duty Mechanism: Imports within the country-specific quota enter duty-free. However, imports that exceed the quota are subject to a variable duty if their price falls below a set threshold. This means importers must constantly monitor market prices relative to the threshold to calculate the duty risk.

Sourcing Strategy: Importers must immediately adjust their sourcing and customs compliance strategies to deal with the TRQ system, non-preferential origin determination, and the three-year duration of the measures (until November 2028).

Impacts on Third-Country Suppliers:

Inclusion of Close Partners: Unlike previous general steel safeguards, these ferroalloy measures apply to all third countries, including close partners like Norway and Iceland. These two countries alone account for nearly half of the EU's ferroalloy imports, and their inclusion has been met with significant protest.

Specific Quota Allocation: Countries with a significant share of imports (over 5% over the last three years, including Norway, Brazil, and India) are allocated country-specific quotas, while others draw from a residual quota on a first-come, first-served basis.

The EU is building a much more restrictive steel and ferroalloy import system. Importers will face:

a. Large cuts to tariff-free quotas

b. Stricter origin rules through “Melt and Pour”

c. New tariff risks on ferroalloys

d. Higher compliance and supply chain costs

For global steel and alloy suppliers, this is effectively a new “Iron Curtain” based on tariffs, quotas, and origin controls, not politics.

References:

Regulation (EU) 2025/2083 – EUR-Lex (Official Source)

Press Corner - 2293

Press Corner - 2698

EU Legal Release

Reach out to our regulation experts on chemical and product regulatory compliances