The November 2025 PFAS regulatory landscape reflects significant developments across multiple U.S. states, with expanded bans, labeling mandates, reporting requirements, and phased restrictions. Consumer products, cookware, textiles, packaging, and selected industrial sectors now face greater scrutiny.

States are adopting multi-stage compliance frameworks that require companies to map PFAS use, increase transparency, and prepare transitions to PFAS-free alternatives. These changes have broad implications for automotive, industrial, and consumer-goods manufacturers.

PFAS (“forever chemicals”) continues to raise public health and environmental concerns. In response, states are introducing preventive measures—ranging from reporting obligations to product-level prohibitions—to reduce exposure.

The November 2025 updates highlight stronger movement toward harmonized state regulations, focused on:

• Source reduction

• PFAS reporting and transparency

• Product-level phase-outs

• Cookware, textile, and outdoor apparel labeling

• Limited exemptions for automotive and industrial uses

Stakeholders must track emerging legislation, map PFAS use, and collaborate closely with suppliers to remain compliant.

1. Massachusetts PFAS Bill – S.1504 / H.2450

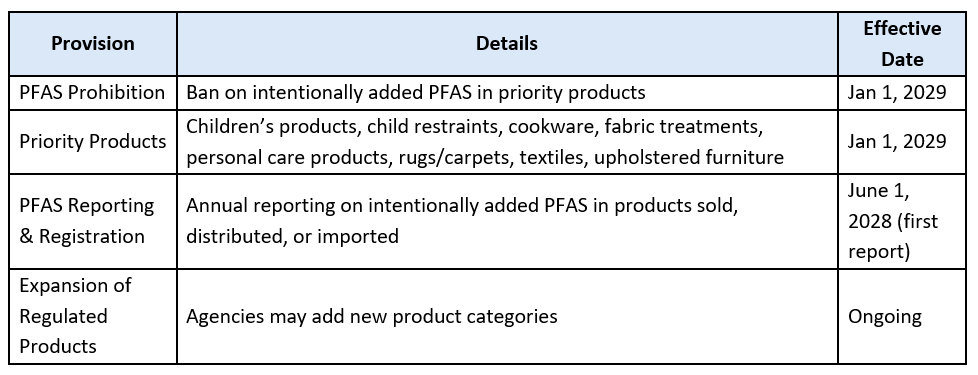

Massachusetts is advancing one of the most comprehensive PFAS restrictions in the United States. The legislation targets intentionally added PFAS in consumer products, with a full prohibition beginning January 1, 2029, and mandatory reporting starting in 2028.

Background

• Introduced to address PFAS contamination in products, water, and waste systems

• Public hearing held on September 10, 2025

• Supported by the Massachusetts Municipal Association and other agencies

• Legislative session ends November 2025, with continuation into 2026

Requirements

|

Industry Implications

• Significant supply-chain impacts for cookware, textiles, upholstery, treated fabrics, and personal care formulations

• Possible indirect impact on automotive interiors

• Companies must establish PFAS inventories, improve supplier disclosures, and plan for reformulation

Next Steps

• Map PFAS usage across product portfolios

• Engage suppliers for declarations and data

• Prepare reporting systems for 2028

• Assess PFAS-free alternatives

• Monitor progress into the 2026 legislative session

2. New Jersey – SB 1042 & AB 1421 (Protecting Against Forever Chemicals Act)

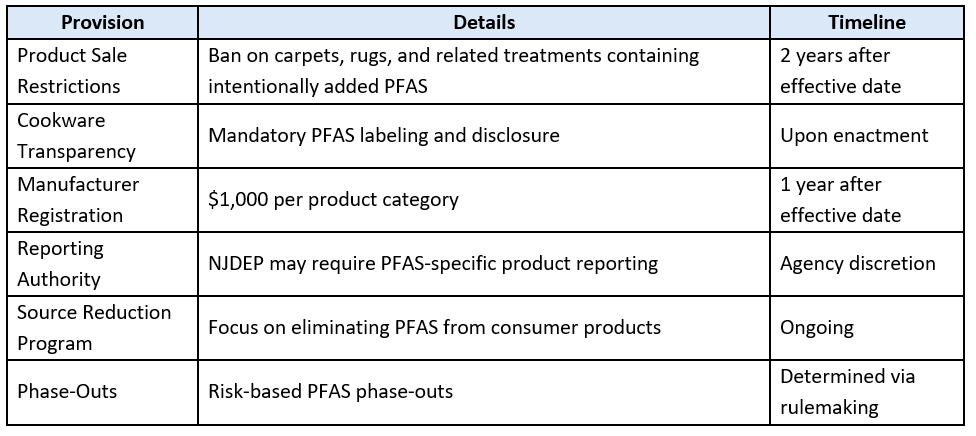

New Jersey continues to pursue strengthened PFAS controls through two carryover bills. While movement has been limited, the proposals remain significant for manufacturers, retailers, and compliance teams.

Provisions

|

Industry Implications

• Manufacturers face registration fees and reporting preparation

• Retailers and distributors must verify PFAS content and product eligibility

Next Steps

• Track bill movement

• Update PFAS compliance and labeling systems

• Prepare for potential NJDEP reporting requests

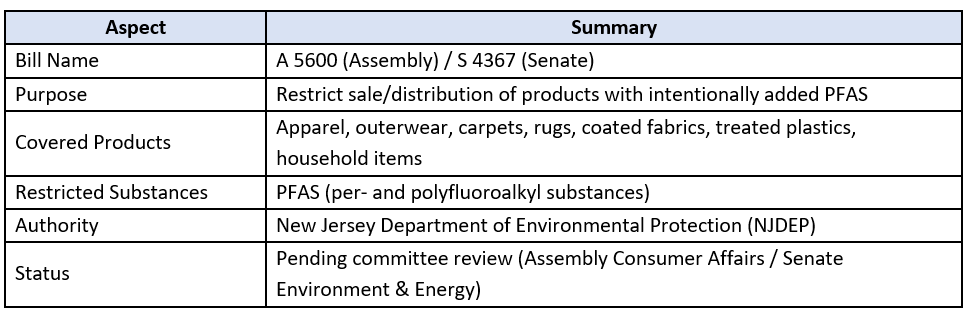

3. New Jersey PFAS Bill A 5600 / S 4367

New Jersey is considering bills A 5600 (Assembly) and S 4367 (Senate) to restrict PFAS (“forever chemicals”) in consumer products, especially textiles, carpets, and coated plastics. The legislation aims to reduce exposure to harmful PFAS chemicals in everyday items.

Details

|

Industry Implications

• Manufacturers, importers, and retailers must audit and reformulate products to remove PFAS.

• Supply chains will need verification and substitution for PFAS-containing materials.

• Products may require redesign, labeling, and compliance updates for NJ market.

• Companies may adopt PFAS-free standards nationwide to simplify distribution.

Next Steps

• Monitor committee hearings in Assembly and Senate.

• Prepare for inventory review and reformulation of affected products.

• Update supply chain and compliance documentation.

• Track similar PFAS legislation in other U.S. states for proactive planning

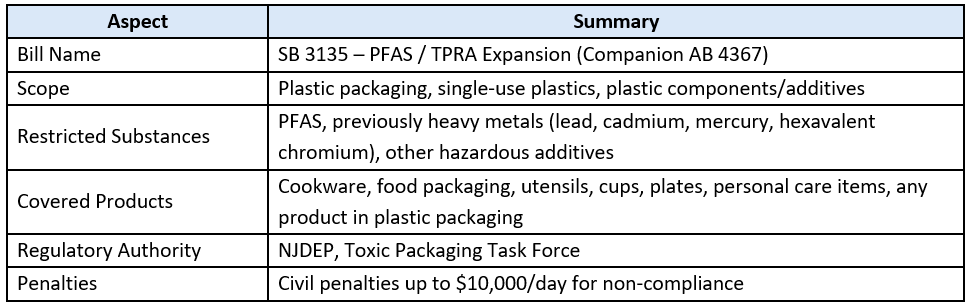

4. New Jersey PFAS Bill SB 3135 (Companion AB 4367)

New Jersey is proposing SB 3135 / AB 4367, expanding the Toxic Packaging Reduction Act (TPRA) to restrict PFAS (“forever chemicals”) in plastic packaging and products. The bill covers a wide range of consumer and industrial items.

Details

|

Industry Implications

• Reformulate products and packaging to remove PFAS and other restricted substances.

• Reduce overall plastic packaging output over a phased schedule.

• Update labeling, compliance documentation, and supply chain oversight.

• Potential redesign of products and packaging for NJ market to meet TPRA requirements.

Next Steps

• Bill is currently under legislative consideration in New Jersey.

• NJDEP oversees implementation, compliance, and potential expansion to additional chemicals.

• Manufacturers and suppliers should monitor updates, prepare reformulation plans, and assess supply chain impacts.

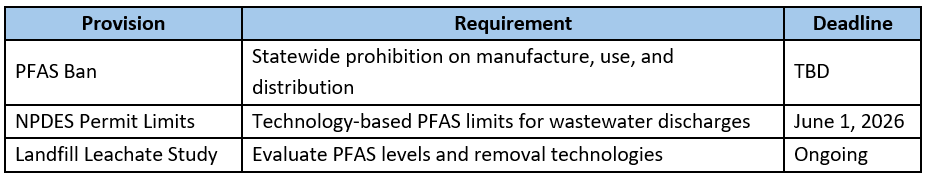

5. North Carolina PFAS Bill – HB 881

HB 881 proposes statewide PFAS bans and wastewater discharge limitations under NPDES permits. Political dynamics reduce the likelihood of passage in 2025.

Provisions

|

Implications

• Industrial and manufacturing facilities face stronger wastewater obligations

• Landfill operators must prepare for increased monitoring

• Likelihood of passage remains low for 2025, but regulatory pressure is increasing

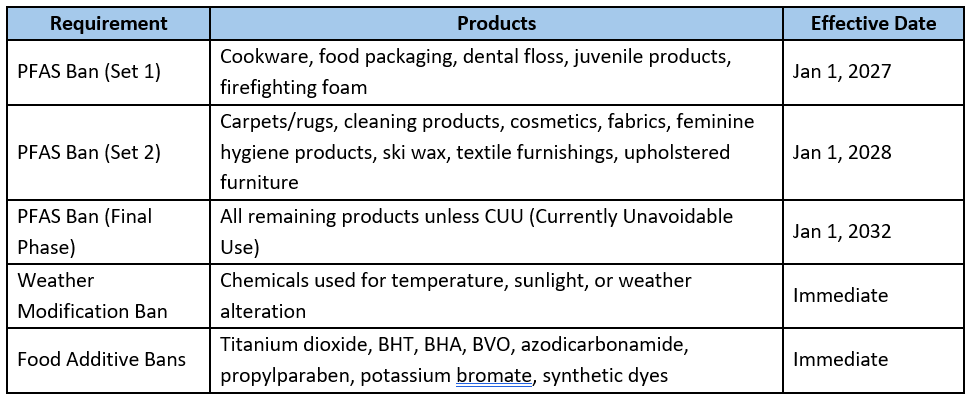

6. Ohio Chemical Safety & PFAS Bill – HB 272

Ohio’s HB 272 addresses PFAS restrictions, chemical safety, food additive bans, and a prohibition on weather-modification chemicals, with PFAS phase-outs extending through 2032.

Provisions & Timeline

|

Implications

• Manufacturers must develop PFAS reformulation plans

• Food and beverage producers must eliminate newly banned additives

• Retailers must prepare for phased PFAS product restrictions

Next Steps

• Monitor legislative direction

• Conduct PFAS usage mapping

• Prepare for phased compliance deadlines through 2032

Summary for U.S. Industry Stakeholders

• PFAS regulation across U.S. states is accelerating rapidly

• Reporting, labeling, and transparency requirements are expanding

• Supply chains—especially textiles, cookware, and consumer products—must proactively map PFAS usage

• Strategic planning for compliance, reformulation, and supplier engagement is essential for meeting deadlines from 2026 to 2032

Reach out to our regulation experts on chemical and product regulatory compliances