The EU wants companies to act responsibly toward the environment and human rights. Large companies are required to report on how their operations impact the environment and society, known as ESG reporting. They also need to monitor their supply chains to prevent human rights abuses or environmental damage, a process called due diligence. Many companies, especially smaller ones, find these rules complex and costly to implement.

Proposed Changes: Making Rules Simpler

1. Reduced Social and Environmental Reporting (CSRD)

a. The EU Commission wanted to cut the number of companies that must report by 80%.

b. MEPs want only the biggest companies to report—those with more than 1,000 employees and an annual turnover of over €450 million.

c. This also applies to sustainability reporting under EU investment rules.

d. For smaller companies: reporting would be voluntary.

e. Big companies can’t push reporting duties onto small suppliers.

f. Sector-specific reporting (for energy, agriculture, etc.) would be optional.

g. Reports would focus on numbers and facts, making them simpler and less costly.

h. The EU would set up a free digital portal with templates and guidelines to help companies report.

2. Due Diligence Rules Only for Big Companies (CSDDD)

Only very large companies are covered:

i. EU companies with 5,000+ employees and €1.5 billion+ turnover

ii. Foreign companies with €1.5 billion+ turnover in the EU

iii. Companies should ask suppliers for information only when there is a risk of harm.

iv. Companies still need a plan to move towards sustainability and align with the Paris Climate Agreement.

Liability and fines:

a. Companies are responsible under national law, not EU law.

b. Maximum fine: 5% of global turnover.

c. The EU will provide guidance for enforcement.

Parliamentary Actions

i. 13 Oct 2025: Committee approved the simplified rules.

ii. 22 Oct 2025: Parliament rejected them.

Votes: 309 in favor, 318 against, 34 abstentions

Reason: Some lawmakers think simplifying too much could reduce transparency and weaken accountability.

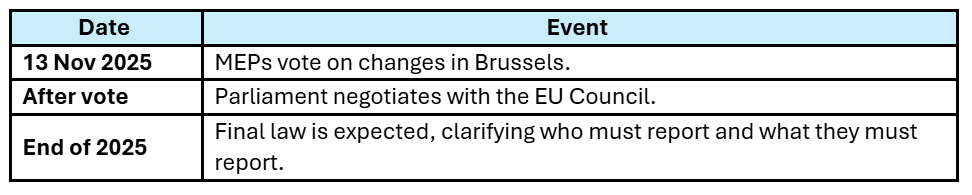

Next: The proposal will go back to negotiation, so companies still need to follow current rules for now.

Impact on Companies

Large companies:

a. They still need to follow full reporting rules unless the simplification passes.

b. They should prepare systems for both full and simplified reporting.

Smaller companies:

a. Relief may come, but voluntary reporting is recommended.

b. Keep ESG records ready in case your customers ask for them.

Suggestions:

a. Use digital tools for reporting.

b. Keep an eye on MEP votes and the final law.

c. Start early to show commitment to sustainability.

Further Action Plans

|

Action for Businesses:

a. Prepare full reporting but stay ready for simplified rules.

b. Update internal processes to handle both possibilities.

References:

i. Simpler rules for fewer companies – EP Press Releaseii. MEPs to vote on simplified rules – EP Press Release

iii. EU Parliament rejects simplification – ESG Today

Reach out to our regulation experts on chemical and product regulatory compliances