Behind the Scenes

The World Economic Forum’s Global Risks Report 2023 presented the Global Risks Perception Survey (GRPS) findings covering short-term and long-term risks. Environmental risks, such as biodiversity loss and ecosystem collapse, have become a major global concern due to their increasing severity over the past decade. Over 50% of the long-term risks stem from the deterioration of the environment.

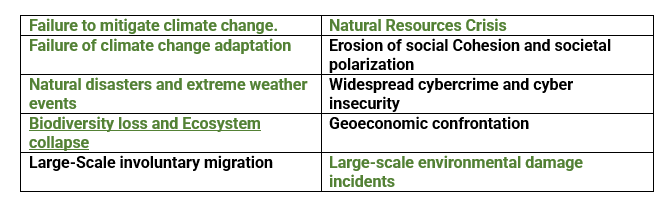

The figure below shows the “Long term Global Risks ranked by severity”. Source – World Economic Forum

Table 1 Long-term Global Risks

Addressing climate change has been and continues to be the top priority!

Much of the focus for businesses and investors over the last decade has been transitioning to a Net Zero Carbon Economy since the Paris Agreement (COP 21) in 2015. Businesses were and still are focused on reducing their carbon footprint and transitioning to renewable energy sources. Investors’ demand for better transparency in climate-related disclosures led to the standardization of the Task Force on Climate-related Financial Disclosures (TCFD).

This reporting standard has been widely adopted across several countries, including the European Union, Singapore, Canada, Japan, South Africa, and the United States. The International Sustainability Standards Board (ISSB) recently published its International Financial Reporting Standards (IFRS) S2 by June 2023 for reporting on climate-related risks and opportunities. This is a continual and ongoing endeavor.

It is evident that climate change and biodiversity loss are interlinked and must be addressed together, as society and businesses negatively impact regional ecosystems, reducing nature’s ability to absorb greenhouse gases and protect against extreme weather. Hence, these two major global risks must be addressed simultaneously to achieve the goal of transitioning to a carbon-neutral society by the middle of the decade.

How COP 15 is setting up the new pace for Biodiversity preservation

Biodiversity loss and ecosystem destruction, pose long-term threats to our well-being and business operations directly and indirectly. According to MCSI ESG research, 50% of the global GDP depends on nature. However, businesses find it challenging to manage the financial risks associated with biodiversity loss and ecosystem destruction due to a lack of information. Data is key for businesses, financial institutions, and investors to incorporate nature-related risks and opportunities into their strategic planning and effective risk management. As the importance of biodiversity and ecosystems in achieving sustainability has become more evident in recent years, governments and global leaders have rightly begun to prioritize it on their agenda. UN Biodiversity Conference (COP 15) – Convention of Biological Diversity held in Montreal; Canada by December 2022 set the pace for adopting the Global Biodiversity Framework(GBF) and has replaced the previous Aichi Biodiversity Targets for (2010-2020). The goal of the biodiversity framework is to mitigate and prevent environmental degradation. The set targets and goals for 2030 and 2050 would be integrated with other existing frameworks like Taskforce on Nature-related Financial Disclosures (TFND), ISSB (International Sustainability Standards Board), EUs Corporate Sustainability Reporting Directive (CSRD), and the EU Taxonomy. Biodiversity is currently receiving more attention within the broader context of ESG.

Based on this new framework, close to 23 targets must be achieved by 2030 and we are running short of time. GBF is voluntary but encourages participant countries to monitor and report progress every 5 years. All these changes will add complexity and reporting obligations for businesses to track their direct and indirect impacts on the ecosystem, leading to due diligence across their supply chain network.

The Significance of the Global Biodiversity Framework

- 1. Nature-related disclosures may become an essential component of reporting for businesses.

- 2. Financial Institutions will be required to strategize and implement nature-based decision-making into their governance process.

- 3. The framework as mentioned above will be incorporated into many existing ESG-related frameworks, which will lead to global standardization and better reporting.

- 4. Biodiversity and Ecosystem targets may require businesses further to extend the scope throughout their supply chain network.

- 5. Appeal to potential investors by highlighting the Corporate Sustainability portfolio.

- 6. By 2030, a total of $200 billion per annum must be allocated from private and public sectors to address the biodiversity finance gap.

Organizations are now required to revisit and remodel their business strategies to incorporate GBF’s ambition to reduce the negative impact on nature and advocate positive policies and actions that would eventually lead to better biodiversity and ecosystems. APA pioneers in compliance and is committed to helping corporations align policies with GBF’s ambitions.

Corporates now need to incorporate GBF under the border horizon of ESG into their strategies while minimizing the negative impact on nature which may require them to revisit and remodel their business.

Reach out to our regulation experts on chemical and product regulatory compliances