A U.S. appeals court has issued an injunction temporarily blocking the implementation of California’s climate risk reporting law, SB 261, just weeks before the first reports were due. The court declined to pause SB 253, meaning California’s major greenhouse gas (GHG) disclosure regime remains on schedule.

SB 261: Climate Financial Risk Reporting Paused

SB 261—targeting companies with over $500 million in annual revenue doing business in California—required firms to publish climate-related financial risk reports beginning January 1, 2026.

This requirement is now suspended until the court hears the pending appeal, expected in early 2026.

SB 253: GHG Reporting Requirements Move Forward

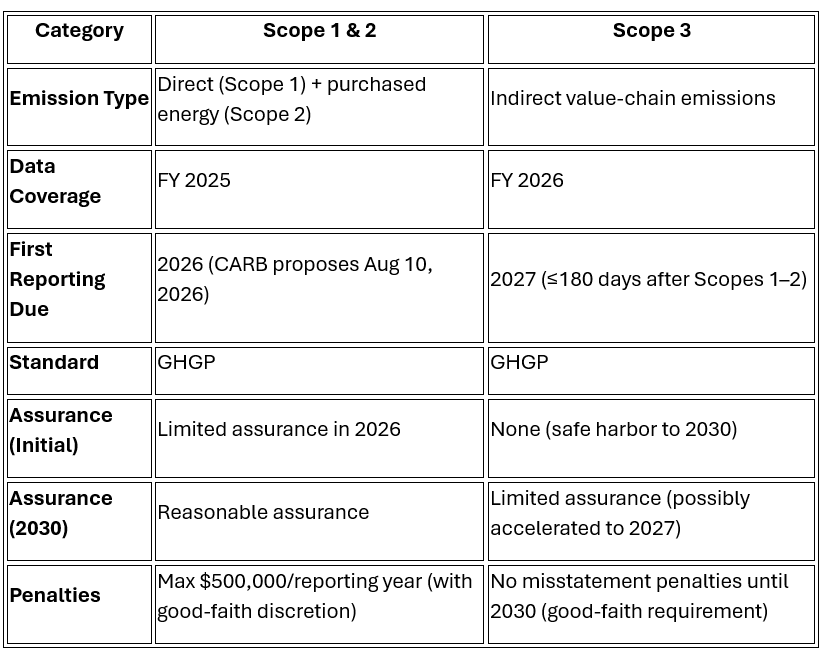

The court rejected the request to halt SB 253 (Climate Corporate Data Accountability Act), which mandates annual disclosure of Scopes 1, 2, and 3 GHG emissions by companies with over $1 billion in annual revenue.

SB 253 Reporting Timeline & Requirements

|

Regulated companies must continue preparing for third-party assurance, GHG accounting, and disclosure under SB 253, as the law remains fully in effect.

Compliance Outlook

The ruling creates a split regulatory environment:

• Companies under the $500M+ SB 261 threshold receive temporary relief.

• Companies under the $1B+ SB 253 threshold must stay on track for 2026–2027 reporting deadlines.

The appeal regarding SB 261 will be heard in early 2026, with potential implications for future compliance timelines.

Reference: California Court Approval

Reach out to our regulation experts on chemical and product regulatory compliances