What is CBAM?

The Carbon Border Adjustment Mechanism (CBAM) is a policy tool introduced by the European Union (EU) to tackle carbon leakage and ensure a level playing field for industries subject to stringent emission reduction targets. Under CBAM, importers of certain carbon-intensive goods must purchase carbon certificates to offset the carbon emissions associated with producing those goods. This mechanism aims to prevent 'carbon leakage,' where domestic producers are put at a competitive disadvantage due to less stringent environmental regulations abroad.

For practical guides on reporting under the Carbon Border Adjustment Mechanism (CBAM) policy, visit these links, as CBAM is set to replace the EU ETS.

Understanding the Iron and Steel Sector

The iron and steel industry is considered one of the most carbon-intensive sectors due to the significant emissions from energy-intensive processes like smelting iron ore and using coke in blast furnaces. However, as eco-friendly practices become more of a priority for global industries, the steel sector faces challenges due to the Carbon Border Adjustment Mechanism (CBAM). CBAM is designed to level the playing field between EU and non-EU producers by pricing carbon emissions, which presents both opportunities and hurdles for the steel industry. It is crucial for the industry to understand the intricacies of CBAM and its potential impact as it navigates this critical juncture. Let’s see the potential impact of CBAM on the steel industry.

What are the 5 CBAM Challenges Faced by the Steel Sector?

1. Administrative Burden: Implementing CBAM requires extensive monitoring and reporting to ensure carbon compliance in the steel industry. This adds to administrative burden and operational costs.

2. Trade Disputes: Implementing the Carbon Border Adjustment Mechanism (CBAM) in the EU may lead to increased trade disputes with its partners, particularly those with less strict environmental regulations. Countries that export steel to the EU market may question the legality of CBAM based on international trade agreements, which could potentially result in retaliatory measures and trade tensions.

3. Supply Chain Disruption: Companies must comply with new regulations, which could disrupt existing supply chains and trade relationships. As a result, it may be necessary to reassess sourcing strategies and business partnerships, which could lead to operational disruptions and increased costs.

4. Uncertainty: Implementing CBAM adds uncertainty to the steel sector, which makes long-term planning and investment decisions more challenging. Fluctuations in carbon prices and regulatory changes may further exacerbate uncertainty, hindering the sector's ability to innovate and adapt.

5. Compliance Costs: Adhering to CBAM regulations demands substantial investments in monitoring, reporting, and verification systems to measure and report carbon emissions accurately. In addition, it requires significant investments in upgrading existing infrastructure and adopting cleaner technologies to reduce carbon emissions. Steel manufacturers may face challenges in financing and implementing these technological upgrades while still maintaining competitiveness in the market. As a result, steel manufacturers, especially those in the MSME (Micro, Small, and Medium Sized Enterprises) or those operating on narrow profit margins, may incur additional expenses.

How CBAM could affect steel trade?

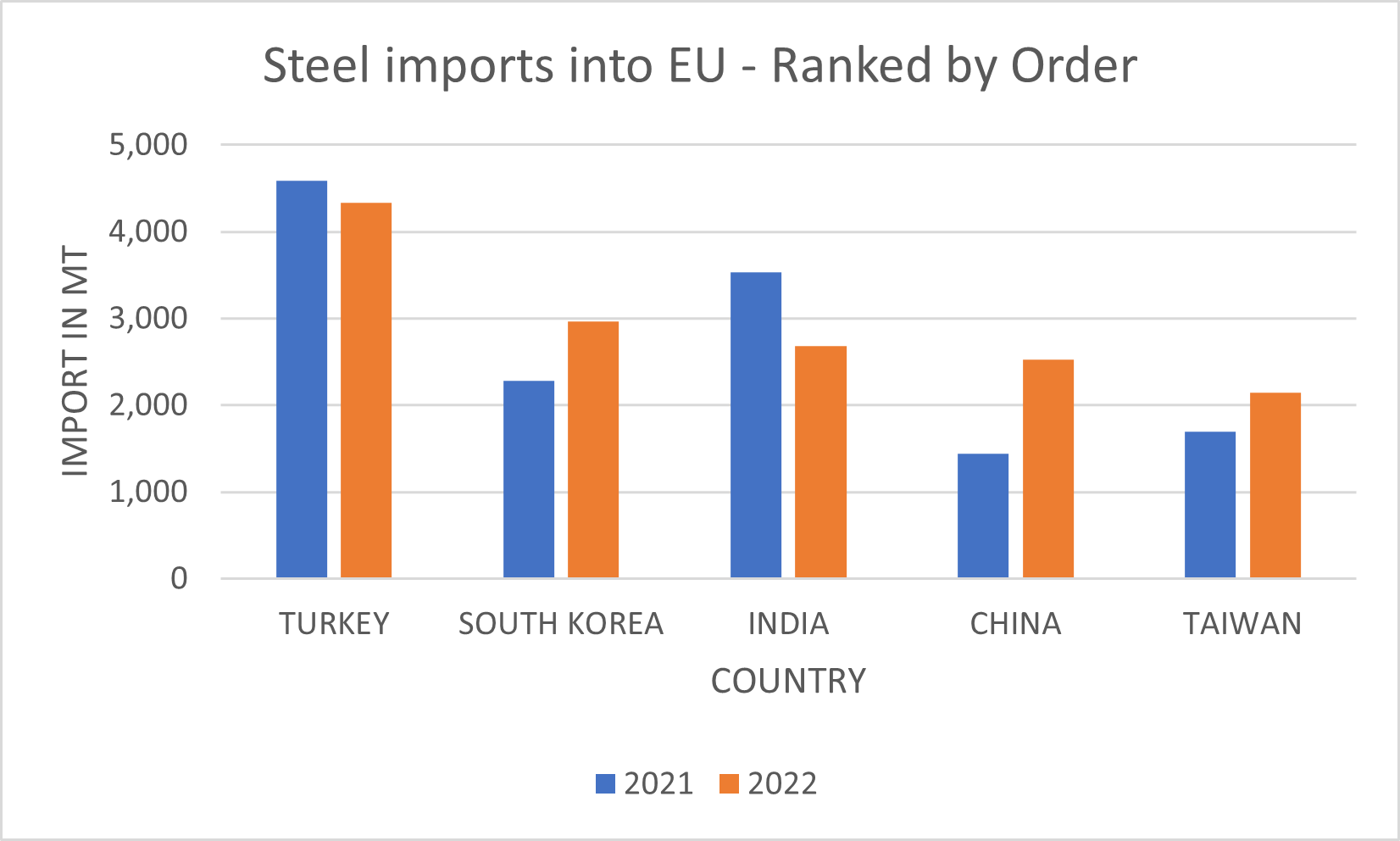

It is estimated that the EU imported 28.9 million tonnes of finished steel products in 2022, with Asia being the largest exporter.

|

Figure 1 STEEL IMPORTS INTO EU - SOURCE EUROFER

During the WTO Committee on Trade and Environment meeting held in June 2023, India and China expressed their concerns regarding the carbon tariff. India's steel sector contributes to about 12% of the country's total carbon emissions, while China and Japan contribute to 15% of their countries' total carbon emissions. If implemented, the CBAM could lead to higher carbon tariffs for products imported into the EU, increasing product costs for exporters, and making them less competitive in the European market.

Japan is already implementing The GX ETS (Green Transformation Emissions Trading Scheme) as part of its Green Transformation (GX) plan to achieve carbon neutrality. India, on the other hand, has amended the Energy Conservation Act with the introduction of the Energy Conservation (Amendment) Act of 2022 to align with global climate goals. However, no emission trading schemes are currently in place, and emissions are priced using fuel excise taxes, as India does not levy an explicit carbon price.

The implementation of CBAM could significantly affect India's MSME sectors, leading to higher administrative and operational costs, which could ultimately impact India's economy. China, being the world's largest carbon emitter, requires extensive decarbonization policies and enforcement to achieve its 30-60 agenda, seeking to peak carbon emissions before 2030 and transition to net carbon by 2060.

Mitigating the Impact

While CBAM presents significant challenges for the steel sector, proactive measures can help mitigate its impact:

• Invest in cleaner technologies and optimize processes to reduce carbon emissions through partnerships and collaborations to overcome common challenges.

• Engage in dialogue with policymakers to ensure a transparent implementation of CBAM during the Ministerial Conference of the World Trade Organization (WTO) in Abu Dhabi starting February 26, 2024.

• One strategy to reduce reliance on EU markets is to diversify the markets and customer base. This can help to mitigate the risks associated with depending too much on a single market.

• Continuously monitor regulatory developments and market trends to adapt strategies accordingly.

Highlights of CBAM in Steel Sector

The introduction of the Carbon Border Adjustment Mechanism (CBAM) highlights the need for the steel industry to adapt to changing market and regulatory dynamics. While compliance with CBAM may come with significant costs and administrative burdens, it also presents an opportunity for the industry to transition towards more sustainable practices. By promoting innovation and collaboration, the steel sector can overcome the challenges of CBAM and emerge as a stronger and more resilient player in the transition to a low-carbon economy.

Reach out to our regulation experts on chemical and product regulatory compliances